Inflation in the UK surged to 3% in January, up from 2.5% in December, marking the fastest rise in ten months. The increase was driven by soaring food costs, higher airfares, and a sharp rise in private school fees.

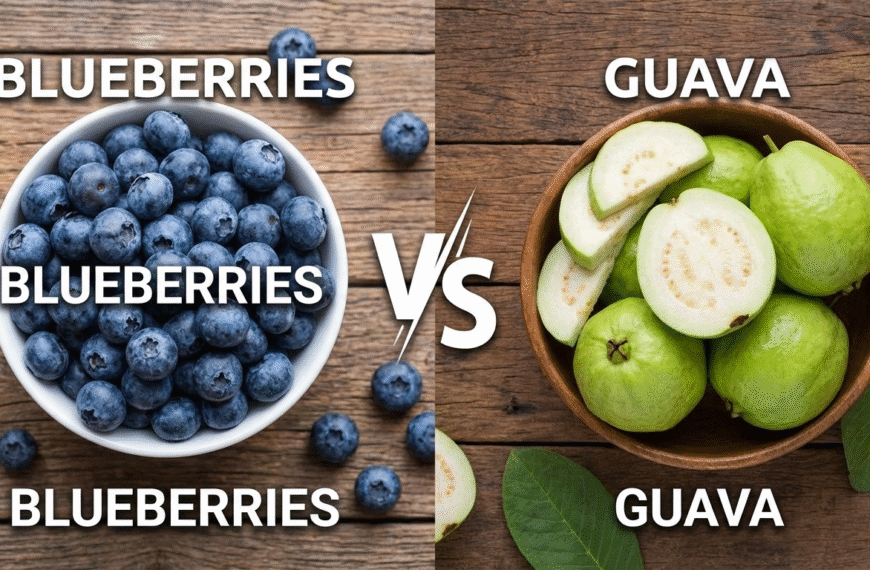

Everyday groceries like meat, eggs, butter, and cereals have become more expensive. Olive oil and lamb prices have spiked by 17% and 16%, respectively. With energy, water, and council tax bills set to rise in April, the cost of living is expected to climb further.

The government has increased the minimum wage, benefits, and state pensions to help households manage expenses. However, businesses warn that rising wages and a higher National Insurance rate may lead to even higher prices.

For many families, affording basic needs has become a challenge. Gaby Cowley, a young mother, shared that food shopping costs have nearly doubled in three years. She now spends around £90 monthly on groceries, with extra costs for fruits, vegetables, and milk. To make ends meet, she sells her baby’s old clothes.

Airfares also contributed to inflation. While ticket prices usually drop in January, the decrease was smaller than expected. Additionally, private school fees surged by 13% after VAT was introduced on tuition from January 1.

The unexpected rise in inflation has sparked speculation about how the Bank of England will respond. Some economists believe interest rates may continue to drop gradually, while others warn that persistent inflation could slow down future rate cuts.

Experts suggest that inflation might remain unpredictable, especially with wage increases for workers in supermarkets and food production. Sarah Coles, a finance expert, highlighted that upcoming tax and utility bill hikes in April could further strain household budgets.

The government acknowledged that returning to a stable 2% inflation rate will be challenging. While officials remain confident in their economic plan, political parties blame each other for the financial strain on households. Critics argue that tax increases and wage policies are fueling inflation, while others worry that the current economic strategy could lead to stagnation.

Despite economic uncertainties, experts suggest that the Bank of England will carefully assess inflation trends before making further changes to interest rates. The key concern is whether rising prices will be temporary or indicate a long-term issue.